How do you use autoreconciliation in Acomba?

You reconcile your accounts manually and you would like to simplify and accelerate this task? Discover how by using the autoreconciliation function in Acomba!

Bank reconciliation consists in comparing your internal statements with the statements provided by your bank. It is a verification and control method to identify inaccuracies or fraudulent transactions that could affect your daily financial operations and the smooth functioning of your business.

Acomba offers you the autoreconciliation function which allows you to do your bank reconciliation quicker and easier. Here are the steps to follow:

01 Download your bank statement

You must first go to your financial institution's website to download the bank statement for the account that you want to reconcile. For your bank statement to be readable by your Acomba software, it must be downloaded in .ofx format.

Once your bank statement is downloaded in .ofx format, you can go to your Acomba software.

02 Import your bank statement in Acomba

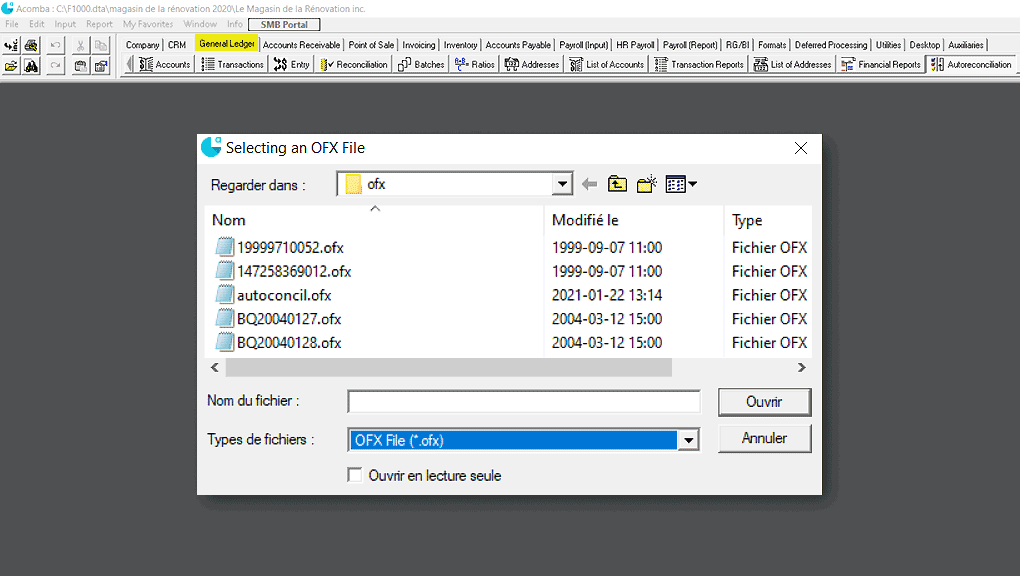

Once you're in Acomba, click General Ledger which is found in your main menu, then Autoreconciliation. A window will be displayed and you must select your .ofx file (the bank statement that you want to reconcile with the equivalent account in your software) and click Open.

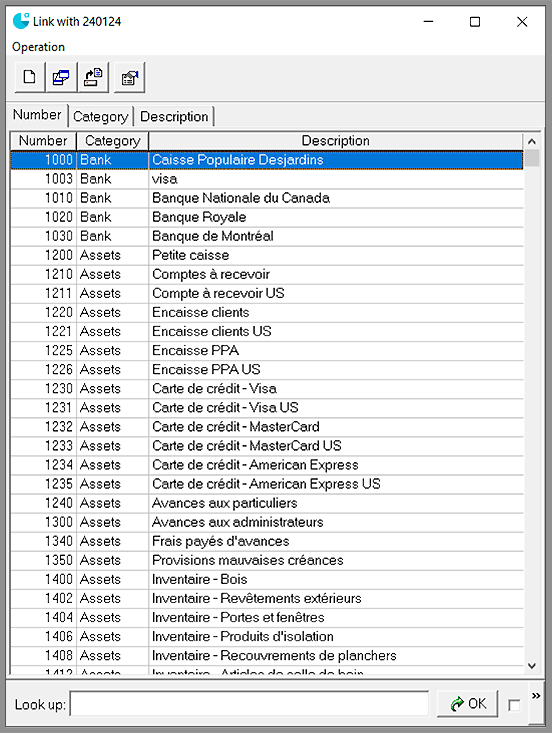

The first time that you perform this operation, you will have to select with which Acomba account you want to reconcile your bank statements. Acomba will save this information and you will not have to repeat this step each time, only when you import an .ofx file for a new bank account.

03 Reconcile your accounts

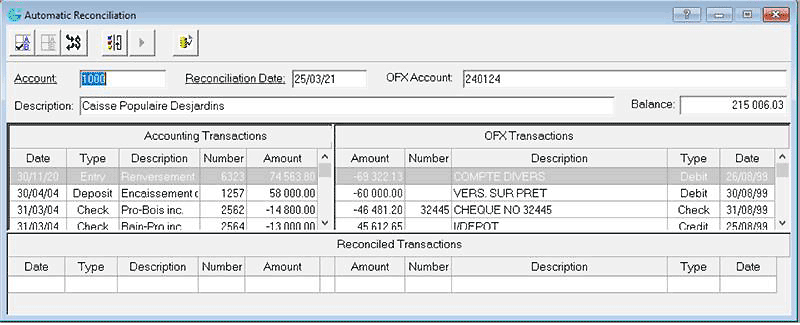

After clicking Open, the reconciliation window is displayed. You must click the Autoreconciliation button at the top, on the left.

Acomba reads the .ofx file and compares the transactions it contains with those of the account that you selected in your software. The software will find and identify for you all identical transactions in the two accounts. These transactions will be moved to the table at the bottom.

The automatic identification of identical transactions makes the process much faster than manual verification and saves you a great deal of time each time you have to reconcile accounts.

04 Verify non-reconciled amounts

Next, all you have to do is check any amounts that have not been identified by the software.

It is important to verify any differences between the two statements. These differences could result from an inaccuracy, an input error or a fraudulent transaction. However, certain differences between the two statements are normal, such as a payment by cheque to a supplier that has not yet been cashed.

If you want to unreconcile transactions, you can do so with the help of the Unreconcile button at the top of the window.

If certain transactions are not reconciled automatically, it is possible that they have not yet been entered in your account in Acomba. You can create an entry in your Acomba account from a transaction in your .ofx file by selecting the transaction from your .ofx file and by clicking the Create a transaction button. You can then reconcile these two transactions.

05 Produce a reconciliation report

Once all your transactions have been reconciled or checked, you can produce a reconciliation report by clicking the Reconciliation Report button, at the top of the window.

Once you have completed these steps, you will have finished your autoreconciliation with Acomba!

The Acomba blog is brimming with articles on business, IT and business management.

Subscribe so you don’t miss a thing!

I am already subscribed